Table of Contents

Cryptocurrency Stable Coins

What is a Stable coin? What is it used for? How are stable coins created and are they really a good idea? What is Tether USDT? In this post, we’ll answer these questions and more regarding Stable Coins.

Why Do We need Stable Crypto Coins?

Most digital forms of money were created to be used as a medium of trade and not simply a store of significant worth. The issue is that due to their somewhat little market cap, even famous cryptocurrencies like Bitcoin will in general experience wide changes in cost. Typically, the more modest a market cap a resource has, the more unpredictable its cost will be. Envision tossing a stone into a little lake in comparison to throwing it in the sea. The stone will have substantially more of an impact on the lake than on the sea. In a similar way, the digital money market cap is a little lake for the time being and is more influenced by ordinary purchases and sell orders than, say, for instance, the US Dollar. This makes a significant issue since you can’t benefit from the advantages of digital currencies which incorporate the decentralization of cash and a “Free for all” instalment framework, without the instability that goes with it. It is so difficult to utilize Bitcoin or some other cryptographic money for everyday shopping and trading when one day it’s worth X and the following day it’s worth Y.

What are Crypto StableCoins?

Stablecoins are an endeavour to make a cryptocurrency that isn’t unstable. A Stablecoin’s worth is fixed to the original cash that we use in our lives which is also called fiat money. For instance, the Stablecoin known as Tether or USDT is worth 1 US dollar and is expected to keep this value regardless of the market conditions. Stablecoins aims to improve monetary transactions with fewer administrative obstacles while maintaining the steadiness of fiat monetary standards.

Uses and Advantages of StableCoins

Like most coins, the basic use case is to use them as a mechanism of trade for everyday shopping. Since these coins aren’t extremely famous right now, nobody truly uses them for normal shopping. The StableCoins are being used for the following purposes:-

- Stablecoins today are mostly being used for cryptocurrency trades. Users and merchants convert their crypto assets into StableCoins when they need to bring down their investment danger. For example, if Bitcoin price is expected to fall, investors convert into USDT. Once it starts increasing again, they again convert into Bitcoins.

- Stablecoins are also being used to move assets and investments quickly between exchanges. This is beneficial as its an efficient and quick manner to move assets and is also less expensive than Fiat trade overheads.

Maintaining Stablecoin Price/ Peg

The primary method to keep the StableCoin price at a level is to establish trust in the crypto coin itself. Organizations back up their Stablecoins with some sort of resource to retain their trust. Some, of the examples, are:-

- Tether USDT claims to hold one dollar each for its one coin

- DGX token claims to hold the gold at par with its coin price.

- Some organizations back their StableCoin with their other cryptocurrency holdings which are visible on BlockChain.

The second method to maintain the price level is through smart contracts which aim to balance price vs Supply chain. As the demand increases, the price increases as well to keep it stable, more coins are introduced. Similarly when demand decreases, price decreases. To level the prices, existing coins are removed from the market.

Now, we will discuss the largest StableCoin cryptocurrency by share, Tether USDT.

What is Tether USDT

Tether USDT is ranked as the fourth cryptocurrency after Bitcoin, Ethereum and XRP with a market capitalization of twenty billion dollars. Tether USDT is one of the most important currencies when it comes to cryptocurrency trading.

Tether in the English language means to link or connect together. So, Tether USDT is simply a stable currency that has been designed in a way that 1 USDT equals 1 USD which is very beneficial when you want to trade cryptocurrency to avoid market volatility which is common among all cryptocurrencies in the market.

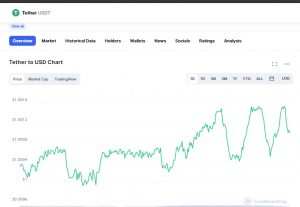

You can see the price history of Tether USDT which remains stable at one Dollar.

Uses of Tether USDT

Some of the other benefits of using Tether USDT are as follows:-

- Tether allows you to move your money between different exchanges easily.

- Tether USDT also assists in arbitrage trading. There is a difference in the price of crypto coins at different exchanges and arbitrage trading is moving your money between exchanges to make this small profit.

- In some countries, some people may not be able to buy cryptocurrencies directly so this way they can ask someone to buy USDT, which is stable and sent it to his account so that he can start trading with Tether USDT.

- Also, there are some swaps that only allow USDT trading so they don’t allow free currencies like Dollars or Euros etc.

- You can also directly stake USDT to earn more profits at crypto exchanges like Binance.

There are also other Stablecoins like EURT which is pegged to the Euro and CNHT which is pegged to the Chinese yuan.

I hope you enjoyed this article and you get the idea. If you have any questions comment below.

Happy Earnings !!!!

FAQ

What are Stable coins?

Crypto Stable Coins are cryptocurrencies that retain their price at a stable rate. They are used to assist trading and help investors in saving their money if the market is moving downwards.

What is the price of one Tether USDT?

The Price of one Ether USDT is retained at one dollar. The organization claims that for every tether they do maintain one dollar as a guarantee.

Can You stake Tether USDT?

Yes, you can directly stake Tether USDT at the Binance crypto exchange.

How Stable Coins maintain their price?

Stable Coins maintain their price with the trust factor. For example, USDT tether claims to retain one dollar for each USDT. DGX tokens claim to retain the equivalent amount of gold.

Disclaimer The Post is only the views of the author and should not be taken as legal or financial advice.